April 15, 2013

Dear Client:

“In coming decades, many forces will shape our economy and our society, but in all likelihood no single factor will have as pervasive an effect as the aging of our population.”

Fed Chairman Ben Bernanke (October 4, 2006)

The world is going through a dramatic demographic transition as fertility declines and life expectancy rises. Most investors pay attention to economic cycles; we should also watch demographic changes, which are like a longer-term wave. Instead of years, demographics are usually discussed in decades. Instead of volatility, demographics are relatively stable.

Demographic trends

There are many academic papers on demographic changes. Among them, I like a report by demographer Joseph Chamie, who gives us a good summary by listing seven trends:[1]

- Global fertility continues to decline. Fertility rates for most developed countries – and an increasing number of developing countries – are at or below replacement levels. African birthrates have fallen to slightly more than 4 children per woman from nearly 7, mirroring the global trend but still translating into rapid population growth for most sub-Saharan African countries for the coming decades.

- Declining birthrates and increasing life expectancies lead to population aging, increasing the proportion of old to young.

- Healthcare needs are growing. Increased longevity means the age group most in need of old-age assistance and healthcare, those aged 80 years and older, is growing comparatively. This raises serious concerns about the financial viability of pensions and healthcare systems for the elderly.

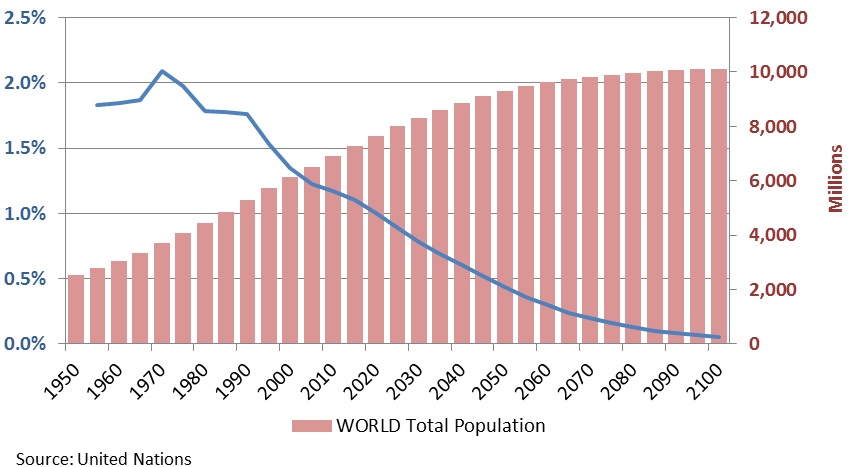

- The world population will hit 8 billion in the next 12 years. The world’s population, which recently reached 7 billion, is growing at 1.1% annually. Although the growth rate continues to slow due to declining birthrates, the 8 billion mark will likely be reached by 2025 (see Chart 1).

- Most of the world’s demographic growth is occurring in less-developed regions. The top seven contributors are India, 22%; China, 9%; Nigeria, 5%; Pakistan, 4%; Indonesia, 3%; Brazil, 2%; and Ethiopia, 2%. Yet over half of the world’s GDP currently comes from the 10 largest economies of the more-developed countries.

- World populations are on the move. Wealthier nations face the difficult choice between opening to more immigrants and remaining with fewer, older citizens. They need manpower, and the youth from many developing countries are seeking opportunities.

- Populations are becoming more urbanized. The world population hit a tipping point in 2010, with more than half of people living in urban centers. One concern is vulnerability to climate change, since many cities are close to coastlines.

Chart 1: Total world population and growth

How will these trends impact the economy?

A useful starting point is to note that GDP can be decomposed into three factors: output per hour worked (labor productivity), the average number of hours worked (labor utilization), and the total number of workers (working-age population).

Labor utilization has been declining very slowly for decades and is unlikely to change in the foreseeable future; in the U.S., it declined about 0.1% annually on average for the past three decades. This factor is so small that its effect on the long-term growth rate of GDP will be minor.

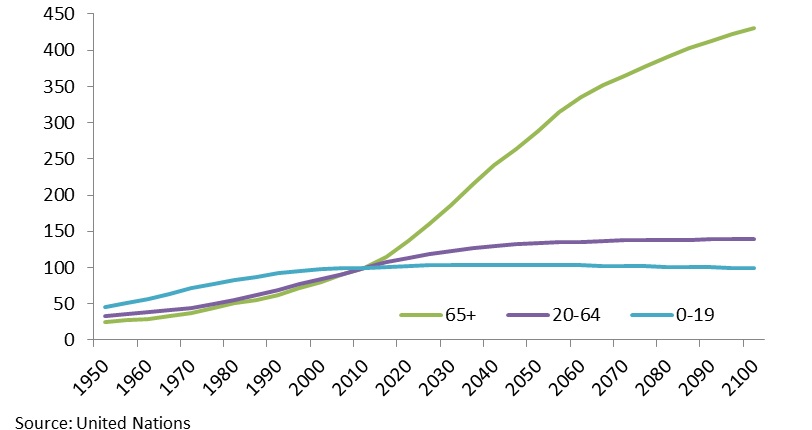

In the U.S., the working-age population (ages 15-64) has grown approximately 1.2% per year on average for the past three decades, while real GDP has grown 2.8%. Looking forward over the next two decades, the working-age population is expected to grow at approximately 0.3% annually, almost one percentage point lower. If the other factors remain constant, real GDP would slow down to around 2%. Worldwide, the working-age population will increase by 13.2% by 2030, while the population aged 65+ will increase by 61.5%, putting pressure on economic growth (see Chart 2). Possible offsets include raising the retirement age, immigration, and entitlement reforms.

Productivity becomes the critical factor in sustaining GDP growth, but the aging labor force will pressure productivity to stay at the same level or slow down. However, productivity growth could benefit from education and R&D, as well as policies such as taxes and subsidies. If we try hard enough, we may be able to offset the headwinds from the aging working-age population.

Chart 2: World Population Growth By Age (2010 = 100)

How could these trends impact financial assets?

We all start to accumulate net worth when we begin to work. Most of the savings accumulated during the first stage go to housing. As we grow older, we shift our focus to investing for retirement, moving an increased proportion of savings into financial assets. Some studies attribute the sustained asset market booms in the 1980s and 1990s to the fact that baby boomers were entering middle age.[2] When we retire, we move our investments from higher-risk assets to lower-risk ones with a focus on capital preservation and a flow of income.

There are many economists focusing on this type of Life Cycle Hypothesis. For example, one study suggests that stock market outflows are positively correlated with the fraction of people aged 65+ and negatively correlated with the fraction of people aged 45-64.[3] Another model shows a high correlation between P/E ratio and the ratio of the middle-age cohort (40-49) to the older-age cohort (60-69).[4] This evidence suggests that equity values are closely related to the age distribution of the population. A related concern is also emerging that a massive sell-off might depress equity values as baby boomers gradually phase from work into retirement over the next two decades.

There are still many factors that can alleviate these trends. For example, longer life expectancy may lead retirees to hold equities as an income source and to leave to their heirs. Also, financial assets are mostly owned by high-net-worth households who don’t need to sell them to fund their retirement. And as investment has gradually become borderless, the correlation between a particular country’s demographics and its asset valuations will become weaker. A younger, growing middle class in emerging markets can buy the financial assets of developed markets. Remember that these trends are long term and population profiles change very slowly. We do have tools to respond to these headwinds, if they are utilized.

For fixed-income securities, the demand might quickly rise. Over the last decade, investors have already begun to move allocations away from equities and into bonds. According to a recent Morgan Stanley report[5], the market cap of the European equity market at the peak of 2000 equaled that of outstanding debt securities. That has shifted, and the European equity market today represents only one-third the size of the debt market. And in Japan, the most aged country on average, mutual funds have been increasingly allocated to foreign bonds, from 4% in 2000 to 24% in 2011.

Unfortunately, unbalanced demand-supply causes yields to be low. To meet their longer-term financial goals based on longer life expectancy, baby boomers may need to raise their risk tolerance in seeking alternatives. This may cause the valuation of high-yield equities to stay high. This hunger for yield will continue to be a long-term secular theme for the asset management industry.

Now What? As long-term investors, what should we do?

To look for investment opportunities, we should learn what products and which services could be positively affected by demographic changes.

- Retirees’ Real Estate: As retirees’ household sizes become smaller, they transition from multilevel houses to more functional, smaller apartments, condos or assisted living facilities.

- Pharmaceuticals and Medical Technology: As retirees look at longer post-retirement lifespans and demand a good quality of life, healthcare plays a critical role.

- Leisure: With more free time, retirees spend more time on leisure activities and traveling.

- Financial Services: The trend from defined benefit pensions to defined contribution shifts the risks from employers to employees, creating a demand for financial planning. To better serve an aging population, we also see a greater demand for transparent and easy-to-understand products.

- Technology & Automation: As baby boomers retire, we need increases in efficiency to help offset the loss of their manpower. Robotics will be a large part of this.

- Emerging Markets: As seen in Chamie’s seven demographic trends, future population growth mainly comes from less-developed regions. These countries become sources of cheap migrant labor or destinations for outsourcing for the aging developed world.

- Natural Resources: As seen over the past two decades, the growth of emerging markets has been creating a construction and manufacturing boom. As they continue to grow, the demand for commodities, natural resources and energy should continue. Meanwhile, the worldwide demand for agriculture is stretching supply capacities.

We believe that equity markets still offer good long-term opportunities and the above sectors will be particularly attractive. However, we should keep in mind that the high levels of equity valuation seen in the past two decades were not sustainable and, in fact, have already reversed. We will continue to dig deep to identify high-quality investment candidates and purchase them at attractive values.

As always, we appreciate your trust in us and the opportunity to serve you.

Sincerely,

Joseph Lai, CFA

Chief Investment Officer

Our most recent Form ADV, Part II is available upon request.