April 15, 2014

Dear Client:

Equity Review & Outlook

After sustaining intra-quarter profit-taking, the U.S. equity market posted slightly positive gains with the S&P 500 Index adding 1.3% and the NASDAQ Composite rising 0.54 %, exclusive of dividends. We suspect the combination of lowered earnings expectations, coupled with the Federal Reserve’s reduction of bond purchases posed a challenge for equity prices, which have not experienced a correction of greater than 10% since the summer of 2012. Federal Reserve Chairwoman, Janet Yellen’s congressional testimony had a far greater impact on equity prices than did news of Russia massing troops and annexing Crimea.

In December, the buy-side analysts were anticipating for the first quarter 4.4% earnings growth for the S&P Index. As of late March, the estimates had fallen to -0.4%. This can be partially attributed to weather interrupting consumer spending, although the spending rebound has been somewhat spotty. Utilities and natural gas providers clearly benefitted at the expense of consumer sectors.

We noted in our January letter, and also in our Capital Markets Outlook, that we anticipated that the reduction of the Fed’s Quantitative Easing would ultimately reduce money supply, creating a stronger dollar. The effect of the stronger dollar should lead to greater volatility in both stock and bond prices, as well as putting pressure on the exchange rates of currencies of weaker, emerging countries. While the Fed continues to purchase $55 Billion of U.S. Treasuries and agency bonds every month (reduced from $85 Billion throughout 2013) the market recognizes the program of printing money is scheduled to end during the autumn of 2014, and is beginning to factor reduced liquidity, along with higher interest rates, into equity valuations.

Meanwhile, economic growth maintains at a slow and steady pace, though not accelerating yet as had been widely expected. GDP for the fourth-quarter of 2013 was revised by the Commerce Department to 2.6% from an original estimate of 3.2%. Estimates in January for 3% GDP for the first quarter have been lowered to 1.8%. The three-month average of employment gains is 178,000; many economist feel we need employment in excess of 250,000 per month in order to indicate a stronger jobs recovery. The labor participation rate of 63.2% has improved slightly, but remains near 30 year lows.

The market experienced significant rotation out of the momentum sectors that led during much of 2013, including consumer discretionary, Internet stocks and bio-tech, while moving into many value stocks which lagged over the past several months.

Likewise, there was a shift among the emerging markets as well. The Emerging Markets Index fell as much as 11.2% during the quarter, primarily due to concerns over slowing economic growth, weaker currencies and potential inflation. The index rallied from the lows to post a decline of 1.9% for the quarter. India and Brazil both stand out among the emerging countries that had weak performance in 2013 but gains through March 2014. In contrast, Japan and Germany, like many other developed countries, performed well in 2013 though not in the first quarter.

Inflation as measured by producer prices (PPI index), consumer prices (CPI index) or personal consumption expenditures (PCE) has remained benign. Both the PPI and PCE are up 1.1% annualized through February, which is below the Fed’s target of 2%. Industrial commodity prices are relatively stable. There remains too much slack in the labor market for broad wage pressure; however, there are signs of some wage pressure among skilled labor in certain parts of the country. As the year progresses, we will likely see food prices continue to creep up due to the extended drought in California and the prolonged cold weather, which may delay planting in the mid-west.

Finally, we would like to offer a comment regarding High Frequency Trading which has garnered plenty of media attention in recent days. Be aware that these traders’ intent is to “scalp” very large orders placed by large institutions, in an effort to make pennies, or a fraction of a penny, on some of the shares of the order. The order must be very large to justify the effort. Given the advances in technology and efficiency over the past 20 years, many trades are routed through electronically and executed almost instantaneously at a better price. As we are not a large institution placing huge orders to buy or sell a particular stock, we cannot see any measurable impact on our clients.

Fixed Income Review & Outlook

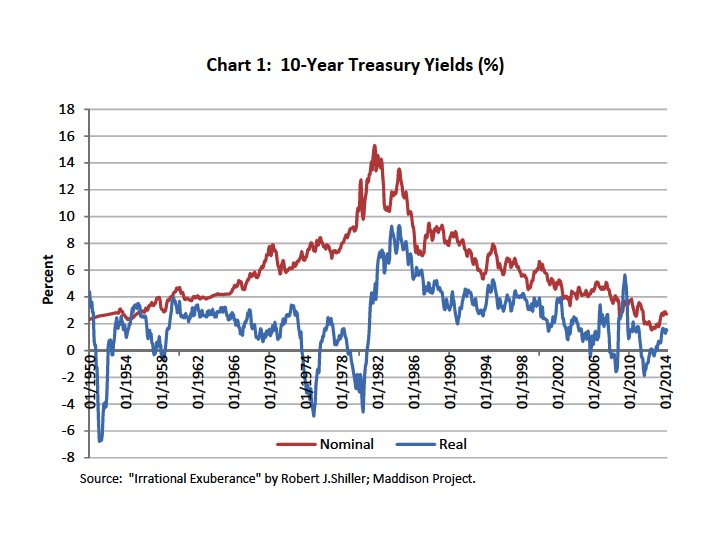

The challenges for fixed income investors continue. Real yields on treasuries stopped their decline and turned to positive territory in recent quarters; however, they still remain at multidecade lows (see Chart 1). After inflation investors earn around 1.5% on a 10-year treasury bond which still compares unfavorably to the long-term average of 2.4%.

Relative to equities, the bond market lost some of its extreme unattractiveness of past years, though this was predominantly the result of the strong stock market and its increased valuation (see Chart 2).

As we have pointed out before, the risk of interest rate increases and consequent bond price declines outweighs the expected returns. The small yield relief of recent months does not alter our thinking materially and we continue to view the bond market as unattractive. We avoid duration in our portfolios coming mainly from long-term fixed-rate bonds. As a result, we are faced with the same challenge every other fixed-income investor in developed markets is confronted with: Finding yield alternatives without taking too much risk of principal. We continue to use high-dividend paying equities supported by sustainable growth potential, investments in niche sectors such as master limited partnerships, and structured securities based on companies with solid fundamentals. In general, we recommend an equity-overweight in balanced portfolios.

While monitoring the slow turnaround in bond markets closely, we want to remain patient and use excess cash for potential opportunities arising from volatility in interest rates or equity prices.

Google Stock Dividend

On April 3, 2014, Google shareholders received a new Class C non-voting share for each existing Class A share with voting power. The new Class C share took over the old symbol GOOG and the Class A share is traded under a new symbol GOOGL. Since this was essentially a stock split, price of the Class A and Class C shares were roughly half of the share price before the split. Google will only issue Class C shares for employee stock options program and for acquisition purchase in the future. There will be no change in voting power for the existing shareholders.

Conclusion

Just as our outlook was in January, we anticipate continued volatility as the Fed works through its process to remove monetary leverage and ultimately normalize interest rates from the historically low levels which have been in place since the great recession. With that in mind, we will look for long-term investment opportunities to buy well positioned companies with sustainable competitiveness at attractive prices.

Noesis means the mental process of acquiring knowledge. In the spirit of mutual learning, please contact us if you have any questions or comments.

Sincerely,

Steve Smith, CFA Shihfang Chuang Christian Paterok

Noesis Research Team