Dear Client:

Volatility is back! Something that seemed almost to be missed by market participants during 2017 returned to the U.S. and international stock markets at the end of January. The potential trigger for the correction was higher than expected wage growth for the month of January and thus the concern of accelerating inflation and faster rising interest rates. An environment of elevated market valuation was an additional contributing factor.

We talked about the potential for a return of market volatility in our January letter, driven by a normalization in short-term rates and central bank balance sheet size in the United States. Major global central banks, led by the Federal Reserve (Fed), are in the process of stopping or reducing their asset purchases and therefore are gradually removing excess liquidity from their economies. In the case of the Fed, the reduction of their long-term treasury holdings should lead to an upward pressure on long-term interest rates over time. We saw this scenario unfolding to some degree during the first quarter, as the 10-year treasury yield rallied from 2.4% up to 2.9% in the first weeks of the year. While the timing of interest rate moves is uncertain, the direction is somewhat clearer after reaching abnormal low levels in the past years.

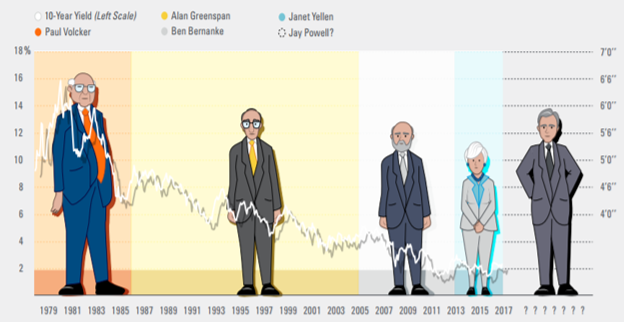

The illustration below (see chart 1) oversimplifies the issue of rates direction, but finds a rather amusing relationship: The height of the reigning Fed Chairperson determines the level of the 10-year yield! Consequently, the arrival of the new Chairman Jerome Powell should mark an inflection point to ever-declining body heights and yields.

Chart 1 – 10 Year Treasury Yield

In recent days, concerns of a potential trade war between the U.S. and China arose as a new source of market volatility. A lengthy escalation from words to real action to retaliation would be the worst outcome. The full consequences are difficult to predict in a world of global trade and interconnected supply chains. However, there exists a mutual dependency between the largest and second largest economy in the world, which should increase the chances of a settlement between the two parties. Our presumption is that expressed threats are just used as negotiation tactics.

We continue to see a synchronized global recovery and rising corporate profits. Most of our holdings ended the year with strong results and gave promising revenue and earning guidance for 2018. The U.S. equity market, while more volatile, moved sideways during the first quarter and valuation on aggregate remained at similar elevated levels as at the end of 2017. Bond valuations also stayed relatively unchanged as spreads (over treasuries) for investment-grade and high-yield corporate bonds widened somewhat but are still far below their historic averages. On balance, economic fundamentals and our outlook did not change, and we see pullbacks as opportunity to add to existing positions or swap into new ones.

We have discussed volatility before and want to revisit some passages from previous newsletters as a reminder of our investment philosophy. In July 2016, after a volatile start to the year, we noted:

From a longer-term perspective, using U.S. stock markets as an example, equity market at times takes pauses to absorb abnormality before the next leg of growth. Although we do not have a crystal ball, the current stage of volatility and sideways swing may be just precedents of more stable growth in the future. At this uncertain time, our investment philosophy is even more important as we remain focused on our companies’ fundamentals and long-term prospects. Market turmoil will work in your favor when we take advantage of short-term volatility to reposition and rebalance your portfolio.

In October 2011, at the height of the European debt crisis, we indicated:

Stock markets worldwide have been selling off and are extremely volatile since late July, with investors understandably anxious about the current economic situation. However, the multinational companies that we follow remain well equipped financially with solid balance sheets and strong cash flow generations … We favor holding good businesses with predictable earnings by paying a reasonable discount to the true values of the businesses … We take advantage of Mr. Market’s emotions to buy companies at very low prices.

During the midst of the Great Recession from October 2008 to April 2009 we wrote:

While investment strategies must include defensive considerations, it is important to also focus on longer range opportunities … We should bear in mind that in previous business cycles equity markets normally began to recover before the economy hit bottom and we are hopeful that this pattern will be repeated in the current cycle … When the environment is as bad as we have been experiencing, it is natural to be pessimistic. We should not invest emotionally when the market is so volatile.

In July 2000, after the burst of the dot-com bubble, we remarked:

During the second quarter, investors experienced one of the most volatile markets in history … $2 trillion of market value disappeared in one week alone … We believe that there are attractive long-term buying opportunities in today’s market. Accordingly, we will take advantage of the short-term volatility resulting from investors’ emotions by buying high-quality stocks in beaten-down sectors that offer promising growth potential. Markets are rational in the long run and ultimately will reflect fundamentals.

It is not just Noesis commenting on market volatility and correction. Some of the most respected minds in our industry have reflected on the subject, as well as emotional behavior, market timing, and patience. We remind you of those insights here:

“A market downturn doesn’t bother us. It is an opportunity to increase our ownership of great companies with great management at good prices.”

Warren Buffett

“The intelligent investor is a realist who sells to optimists and buys from pessimists.”

Benjamin Graham

“In the short run, the market is a voting machine. In the long run, it is a weighing machine.”

Benjamin Graham

“The investor’s chief problem – and his worst enemy – is likely to be himself. In the end, how your investments behave is much less important than how you behave.”

Benjamin Graham

“I make no attempt to forecast the market – my efforts are devoted to finding undervalued securities.”

Warren Buffett

“Far more money has been lost by investors trying to anticipate corrections, than lost in the corrections themselves.”

Peter Lynch

“The stock market is a device to transfer money from the impatient to the patient.”

Warren Buffett

“Waiting helps you as an investor and a lot of people just can’t stand to wait. If you didn’t get the deferred-gratification gene, you’ve got to work very hard to overcome that.”

Charlie Munger

“The best way to measure your investing success is not by whether you’re beating the market but by whether you’ve put in place a financial plan and a behavioral discipline that are likely to get you where you want to go.”

Benjamin Graham

Emphasizing the last quote, we at Noesis are strong believers in investment discipline and following the set course of a financial plan through rough waters. Market fluctuations are inevitable, and we always strive to capitalize on them in your portfolios. However, we should also remember our main mandate at Noesis, as noted in our 2015 Life Goal Investing newsletter:

… what should our objective be? And how do we manage risk and prepare for volatility in the markets? The reasons we accumulate and invest our wealth are: a) Our portfolio provides income to supplement our income needs b) Our portfolio grows over time (during economic cycles of boom and bust) by more than inflation. If we can accomplish this – to provide income and protect against inflation – then we never run out of money. We accomplish financial peace of mind! When we have financial peace of mind, we no longer need to worry about the headlines in the news or volatility in the markets. Worry leads to emotional decisions that can ruin our portfolios and retirement goals.

Thank you for joining our Noesis family and for placing your trust in our group. As always, feel free to contact us with any questions. And if you know someone we can help, please point them in our direction.

Sincerely yours,

Research Team

Form ADV is available upon request