Dear Friend:

Mister Market worries during the fourth quarter of 2018 seem to have completely vanished one quarter later. The outlook for global growth has not necessarily improved much since the end of 2018, but the perception of risk has declined. Trade negotiations between U.S. and China, and U.S. and EU seem to be progressing and public comments from the involved parties became more constructive. Growth expectations remain for a slowdown from a high to a still healthy level, as we pointed out last quarter.

- For the largest 500 U.S. public companies, that means from 22% earnings growth in 2018 to 9% in 2019.

- For the overall U.S. economy from 2.9% to around 2% of GDP growth.

- For the Eurozone from 1.8% to around 1%.

- For the global economy from 3.7% to around 3.3%.

Meanwhile, valuations started this year at reasonable levels. In the case of the U.S. market, this refers to its long-term average. Looking closer, we can note a slowdown of manufacturing activities particularly in export-orientated nations such as Japan, Germany, Korea, or Taiwan. This is most likely an outcome of the trade tensions from past months. The hope is that more certainty in trade policy and cancellation of announced tariffs will reverse the negative trend. On the other hand, service activity on a global level remains unchanged, a sign that domestic demand is holding up (see chart 1).

Chart 1 – Global PMI for Manufacturing and Services

Source: J.P. Morgan, IHS Markit

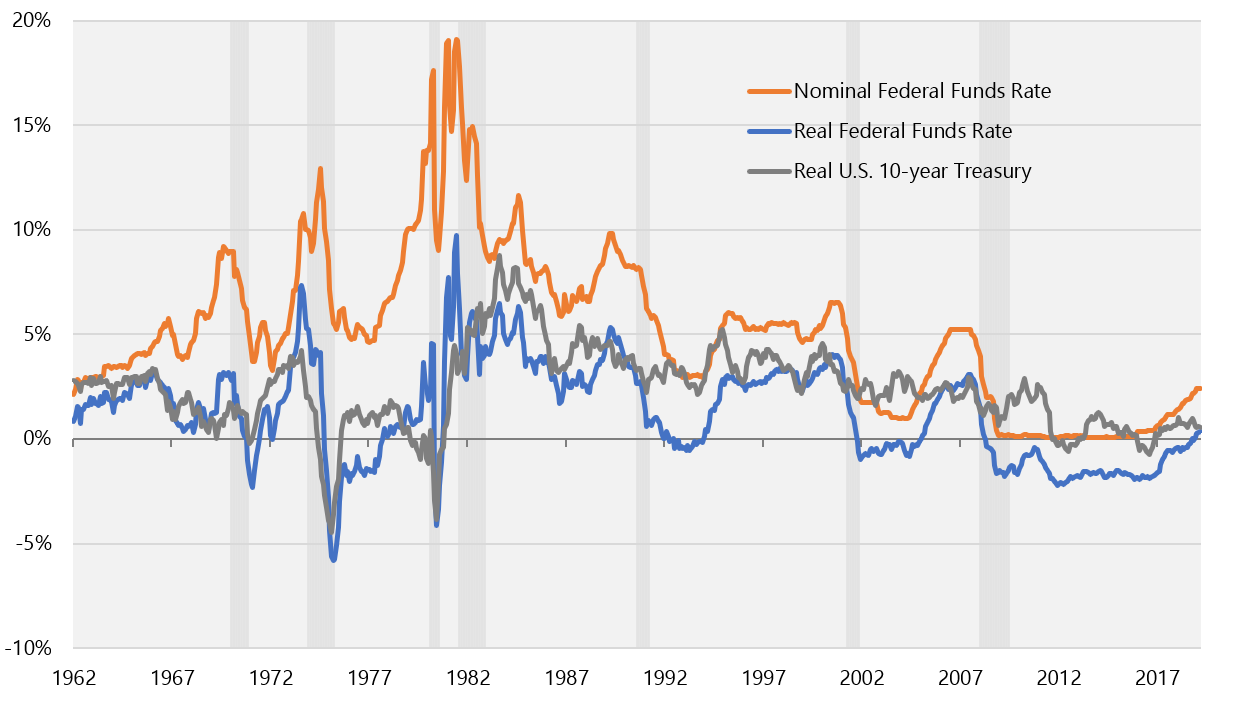

These developments were nevertheless sufficient for the US Federal Reserve (Fed) to stop its interest rate increases at least for the rest of this year. It is a sobering outlook for fixed income investors: the rate hiking cycle might have peaked at 2.4%, roughly half the level from the last peak in 2007, and a testimony to the structurally low-interest rate environment developed markets are experiencing in the past decade (see chart 2).

Chart 2 – Nominal and Real Effective Federal Funds Rates and U.S. 10-year Treasury

Source: Federal Reserve Bank of St. Louis, U.S. Bureau of Labor Statistics

To summarize, global economic activities are slowing, but not alarmingly, while the U.S. as well as the European central banks are becoming somewhat more accommodative. Mr. Market meanwhile lost its nerves only to regain them back a few weeks later. Once again, we learn that ignoring the noise as much as possible and focusing on the fundamentals of economies and companies – as well as their valuations – increases positive long-term results. Investors must resist making drastic changes to asset allocations purely based on fear; instead, they should continue to stay the course and find good quality, reasonably valued companies to meet their cash flow needs.

Operations Change at Noesis

Many of you know that our colleague Jennifer Tang left Noesis in February. We would like to thank Jennifer for her dedicated service over the past 18 years and wish her well in her future endeavors. We are fortunate that after a short but intense search, we were able to find a wonderful addition to our team. Megan Davison joined Noesis last quarter to lead our operations efforts going forward. She has great industry knowledge and we hope you get to know Megan this year.

Born in Methuen, Massachusetts, Megan attended Southern New Hampshire University where she majored in Business Administration. Megan always wanted to move to a warmer climate. Therefore, she relocated to Orlando, Florida after graduating and was quickly recruited by Charles Schwab & Co., Inc. where she worked in the Private Client Group. She joined Schwab Advisor Services as a client services representative, and then was promoted to a new role in Boca Raton, Florida. She worked with Schwab Institutional clients for a year and was promoted back to Orlando to support a select group of institutional clients. Megan then joined a Registered Investment Advisor (RIA) based in Miami, where she flourished for seven years. Megan and her husband Josh were blessed with a daughter, Giada, in 2017 and the family decided to move to the Boca Raton area.

We asked Megan what attracted her to Noesis and what she likes most about working here.

“Everybody is really open, it’s a family environment. All my colleagues are willing to learn, and when you’re in this industry you can’t view everything as black and white, so this is encouraging. Everyone has been really nice and helpful – I’m not on my own, it’s a team environment.”

Megan with her husband and daughter at polo

“I have always enjoyed helping people, and Noesis’ role as fiduciary for its clients as well as how Noesis provides the ‘family office’ feel for them were very important factors in my decision to join.”

Megan anticipates intensifying our push at Noesis towards a paperless environment – i.e. electronic communication and the possibility of a client portal which would allow our clients to log in and view communications, statements, documents, and quarterly reviews. In her new role, she will be responsible for taking lead on existing projects long in process at Noesis.

“We are looking to update our trading and portfolio management system to be even more efficient. We are working with new compliance partners to build a strong cybersecurity policy to protect our clients. Client portal and dual factor authentication are the wave of the future, very necessary in the near term to help protect our client’s data.

Since Megan aptly brought up this very important and timely subject, we shift gears to address Cyber Security from the perspective of you, our clients.

Cybersecurity – Some Steps to take to Avoid Fraud

J.P. Morgan CEO Jamie Dimon, in his Letter to Shareholders dated 4/4/19, said: “The threat of cybersecurity may very well be the biggest threat to the U.S. Financial system.” He did go on to say, “The good news is that the industry (plus many other industries), along with the full power of the federal government, are increasingly being mobilized to combat this threat.”

Along with our custodians, Noesis has been taking measures to protect you from Cyber Crime. Some of you have already experienced this – perhaps when you requested a wire to a third party, and we called you personally to verify your identity to confirm that you made the request by email. Noesis (and your independent custodians) will continue to proactively take steps to safeguard your assets.

Here are some examples of things you can do as individuals to protect yourself against Cyber Crime:

Update your Operating System! Additionally, make sure you have the latest anti-virus, malware, and spyware software on your computer and any other devices.

Create strong passwords! Try not to use a variation of your name, pet’s name, child’s name, address, or anything that can be easily discovered by a routine glance at social media or public records. Also, it’s best to CHANGE your passwords frequently, especially your email password(s).

Logging into your financial services websites (bank, custodian)! Consider the option for dual-factor authentication as it is made available to you by the financial institutions. At Noesis we use it to access your secure data at the custodian. One example of dual-factor is having the responsible party text you a code which you are then prompted for at the website. Alternatively, they will call you with the code if you do not text. Most importantly, try to avoid visiting unknown websites.

Email! Try not to send personal, sensitive information via unsecure email or open emails from unknown senders. At Noesis, we use encryption to both share and gather sensitive information from you. Please contact your Financial Advisor at Noesis for assistance.

Do not use public Wi-Fi! While it may seem convenient if you access any financial sites which require you to enter a password to gain access, using unverified public wireless networks may expose you to cyber thieves. This relates to any device that is Wi-Fi enabled.

Social Media! If you are a Facebook user remember your information is public. If you “check in” to a restaurant or venue, cyber thieves know you are not home, and the same goes for vacation photos, etc. It is best to post those photos AFTER you have returned. Additionally, there are quizzes and games on Facebook that ask for information (an example would be your phone number growing up or your first pet’s name). This information is gathered and when cybercriminals get to work trying to discover your password, they use that familiar data against you (another reason to use strong passwords that do not contain personal information).

As always, please contact us with your questions, and thank you for your continued business.

Sincerely,

Noesis Research Team

Form ADV is available upon request