July 15, 2013

Dear Client:

Ben Bernanke finally clarified his exit strategy at the June 19th Federal Open Market Committee (FOMC) meeting. The Fed plans to keep its target interest rate near zero as long as unemployment remains above 6.5% and the near-term inflation outlook stays below 2.5%. The central bank will begin reducing Quantitative Easing (QE) later this year and conclude purchases by mid-2014 if the economic recovery stays on track. The surprise move to reduce stimulus earlier than expected sent

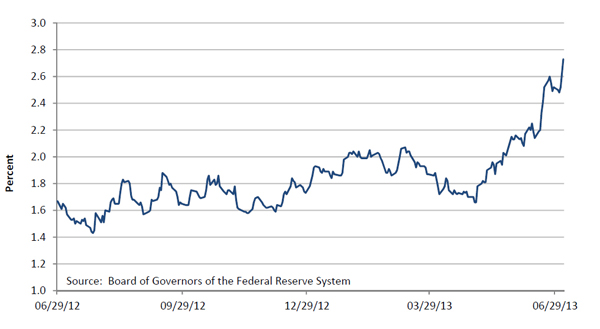

equity markets reeling. Bond markets reacted as well, with rates increasing as prices declined, as seen below.

Chart 1: 10-Year Treasury Yield (past 12 months)

We have been concerned that prolonged QE has distorted incentives. QE is like life support for the economy – its purpose is to revive the economy and gradually help it run on its own. But after five years, the economy still remains in the Emergency Room (ER). This is a serious concern. QE must end; the critical question is, “When?” If it comes too soon, the still-weak body might not survive. If it comes too late, the body might become dependent on ER support.

As PIMCO’s Bill Gross said in his June newsletter, “Capitalism without profits is like a beating heart without blood.” Indeed, profit can stimulate new investment (oxygen) to the economic body. Unfortunately, yields have been low for so long, investors are unwilling to risk financial capital and the economy could die for lack of oxygen. Five years of loose monetary policy has paralyzed capitalism (the heart).

We have argued that the current economic weakness is not only a cyclical issue but also a structural one. Japan’s “Lost Decades” provide a cautionary tale. The Bank of Japan has held its interest rate near zero for almost two decades and the government has also kept its fiscal policy extremely loose. However, the NIKKEI 225 Index remains at a level approximately 2/3 off its 1989 peak and average housing prices nationwide also stay 2/3 below their highs. Japan’s Consumer Price Index has hovered at or below zero since 1997, so the country has been in a deflationary state. The Japanese economic recovery remains just a dream. The nation has been hit hard by the aging of its population. As we discussed in our last quarterly report, this is a particularly difficult demographic trend: No matter how low the interest rates are, the aging populations are just not willing to open their wallets. As such, the increase in money being printed is simply saved back into banks – it doesn’t help to stimulate the Japanese economy.

Fortunately, the United States is not yet in Japan’s situation. For example, we have a much friendlier immigration policy, which eases our demographic pressures compared to most other advanced economies. But to avoid falling into our own Lost Decades, we need to deal carefully with issues such as high leverage, high unemployment, and low investment. And the longer we stay in the ER on the life support of Quantitative Easing, the more difficult it becomes to walk away.

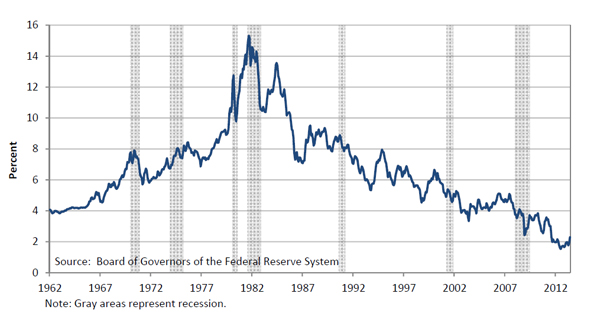

U.S. interest rates have been sliding for three decades to its historically lowest levels (see Chart 2). As short-term interest rates were approaching zero, we realized that there was not enough yield. Because the interest rates could not fall below zero, the risk levels were becoming high: Bond prices would fall, as interest rates had to eventually increase. As such, we have argued in recent quarters that the bond market has been unattractive. From a short-term viewpoint, recent interest rate increases have made the bond market slightly less risky than months ago. Bond investors can breathe a little easier for the time being.

Chart 2: 10-Year Treasury Yield (long-term)

As you know, we generally favor equities over bonds from a long-term viewpoint. The recent market correction worldwide is welcomed. As the US economy gradually recovers and the stock market remains undervalued relative to the bond market, we will continue to favor equities.

Asia Trip

The 66th Chartered Financial Analyst (CFA) Institute annual conference was held in Singapore this May. Singapore is hot and humid in June, but the city-state was as pretty, clean and safe as I could have hoped. Similar to the U.S., Singapore is a melting pot of races. Chinese represent the majority, with almost 75% of the total population; Malays and Indians form significant minorities. While I heard many different dialects on the street, I found that most locals speak reasonable English. As a highly regulated state with a friendly immigration policy, Singapore has attracted much foreign talent (less than 60% of the population is born locally) and has become a financial center in Asia.

The CFA annual conference is considered one of the most important events among professional investors, and we at Noesis are committed to attending every year. In the past, we have not only gained new knowledge and investment ideas from the event but also networked with professionals from around the globe. We will continue to attend this event and hope to share some great thoughts with you. Most important, we believe that it helps sharpen our investment judgment and should be beneficial for all of you.

Speakers for the conference include prominent economists, investment practitioners, policy makers, and industry leaders. For example, we were honored this year to have Tharman Shanmugaratnam (Singapore’s Deputy Prime Minister and Minister for Finance) and Thomas Sargent (an NYU Professor who was awarded the 2011 Nobel Prize in Economics for his research on cause and effect in the macroeconomy). Last year, we had Sam Zell (a real estate legend), Mike Mayo (a highprofile

sell-side analyst covering the banking industry), Daniel Kahneman (a professor at Princeton University and 2002 Nobel laureate in Economic Sciences) and Eugene Fama (a University of Chicago professor who is considered the father of the efficient market hypothesis).

Some of the most fascinating discussions at this year’s conference centered on the issue of aging populations and its long-term impact on global economic growth, risk management and investment opportunities. Let me share with you three speeches that I considered particularly relevant.

Tharman Shanmugaratnam argued that confidence in advanced economies is quite low, as seen in corporations holding cash and issuing bonds to buy back shares rather than investment. Serious structural deficiencies were built up many years before the financial crisis, so we cannot expect a normal cyclical recovery using the conventional tools. Shanmugaratnam sees a lack of progress on fiscal consolidation, overreliance on monetary policy, and lack of progress on structural reforms such as entitlements. The most vital issue is that the longer we stay in un- or under-employment and cut back on public investment, the greater our risk of low economic growth.

Michael Woodford recounted the alarming story of his personal experience in Japan. He had been appointed CEO of the Olympus Corporation in October 2011, the culmination of a 30-year career with the company. As he did what he thought was a simple job, Olympus’ stock price continued to climb: “I realized how easy it was because in Japan, everyone does what you tell them to do.” However, it didn’t last long. The mainstream Japanese media self-censors stories to protect Nikkeilisted stocks, according to Woodford. So as he began to ask questions about an article in a small investigative magazine, FACTA, regarding inexplicable payments of $1.7 billion, he was stonewalled by the chairman, Tsuyoshi Kikukawa. He learned that the fraud was linked to organized crime in Japan, and he realized his career was not the only thing at stake. His personal safety was in peril, he said, as he was accompanied by no fewer than 30 “bodyguards” in Tokyo, acting as minders. Eventually, he was fired and saw the stock price fall more than 80%.

Woodford is cautious about Abenomics, the economic policies advocated by Japanese Prime Minister Shinzo Abe. He thinks it is related to Japan’s culture: nothing can be changed, as Japanese are only interested in their own club. I have made similar observations on my previous trips to Japan and have found that Japan is quite isolated. For example, they are not very welcoming to immigrants. During a layover in Tokyo’s Narita International Airport on my latest trip to Singapore,

many of us foreign travelers lined up without clear guidance in English. We had to pass through a gate where the service personnel could barely speak English. I found that unacceptable for such an international airport, especially in the capital of an advanced economy.

Lim Chow Kiat, CIO of Government of Singapore Investment Corporation, argued that we arrived in our low-yield world after traveling down a massive, 30-year credit expansion cycle. This was the result of a long disinflation trend stemming from the monetary policies of Paul Volcker, the chairman of the Federal Reserve from 1979 to 1987, along with globalization and the supply shocks caused by a billion Chinese workers competing globally on the basis of low wages. He suggested that investors must recognize the necessity of preparing for the eventual reversal of the credit expansion cycle.

There was also some discussion of China. Most people agreed that the double-digit growth seen in the past three decades is not sustainable. Growth that potentially slows down to 6%-8% is healthy and sustainable. In fact, the new administration led by President Xi Jinping and Prime Minister Li Keqiang is working hard to guide China to the next level. According to a personal friend of mine who is running a successful business in Mainland China and has met Xi Jinping in person, the president is an honorable person. He has high hopes that Xi will sacrifice short-term profit in the pursuit of long-term success. We look forward to seeing some serious progress being made in the coming years.

These are just a few highlights of what I learned in Singapore. If you’d like to discuss further, or have any questions about your portfolio, please don’t hesitate to contact us. And as always, we appreciate your trust in us and the opportunity to serve you.

Sincerely,

Joseph Lai, CFA

Chief Investment Officer

Our most recent Form ADV, Part II is available upon request.