Dear Client:

We want to share with you what we learned at the recent CFA Institute annual conference in Seattle. One of the main topics was behavioral finance, which studies human behavior and its impact on financial decision making. Not to our surprise, it shows that market participants do not act as rationally or efficiently as traditional financial theory assumes.

Behavior Gap

Various studies quantified the outcome of this irrational investor behavior. These studies all found that equity mutual fund investors did not achieve the same returns as the funds that they invested in. The difference between the investor return and fund return is called the behavior gap.

The chart above shows the underperformance of the average mutual fund investor over different time periods. Over the past 20 years, the average investor gave up 4.2% annual return compared to the mutual fund return. It clearly represents the penalty for emotional investor behavior.

Herding

One example of investor behavior is following the herd – investors trading in the same direction or in the same securities and possibly even contrary to the information available to them. The following chart visualizes investor actions by comparing market returns with net flows of equity mutual funds and exchange traded funds (ETF).

In the year 2000, during the Internet hype, investors poured record sums into equity funds at the peak of the market, and subsequently withdrew their funds when returns deteriorated. In the year 2008, market participants sold their mutual funds and ETFs at the market bottom of the Financial Crisis and missed the following recovery in 2009. In 2011/2012, during a time investors questioned the US economic recovery and Europe dipped back into recession, the crowd sold its funds and missed the recent strong returns.

Buying at “highs” and selling at “lows” is a common mistake that investors make. Herd behavior emphasizes the past performance of a “hot” topic, which results in blind investment that disregards both the current and future fundamentals. If an investment story is well known, the price probably reflects the information. It is not easy for top-performers to continue the winning streak and match the ever raising expectations. Similarly, assuming the underperformers will never recover is a mistake that ignores the possibility that even minor improvement could be greatly celebrated. As Warren Buffet once famously said: “Be greedy when everyone else is fearful and be fearful when everyone else is greedy.” It feels more comfortable to trade with the consensus of a group than to act against the majority. However, herd behavior, as previously shown, generally hurts investors’ long-term returns.

Market Timing

Some investors might recognize the herd behavior but still believe in their ability in market timing. Instead of focusing on what can be controlled and following through their long-term financial plans, they think they can outperform the market by moving in and out frequently at the right time. However, this overconfidence can result in a perilous situation.

The graphic illustrates the opportunity costs if an investor missed the best six months over the past 10 years. For a large-cap investment, the investor would have missed close to 7% return per annum. The losses for mid-cap and small-cap investments would have been even higher. In his recent shareholder letter, Warren Buffet commented tellingly on market timing: “Focus on the future productivity of the asset you are considering. If you instead focus on the prospective price change of a contemplated purchase, you are speculating. There is nothing improper about that. I know, however, that I am unable to speculate successfully, and I am skeptical of those who claim sustained success at doing so. Half of all coin-flippers will win their first toss; none of those winners has an expectation of profit if he continues to play the game. And the fact that a given asset has appreciated in the recent past is never a reason to buy it.”

Noise in the market

In the short-term, security prices fluctuate with the overall market sentiment, macro data, and individual company news. However, in the long-run, prices still reflect fundamentals. The recent soccer match between the U.S. and Portugal at the World Cup serves as a good analogy of how the focus on short-term events alters our judgment of long-term results. Portugal scored one goal early in the first half, so we started in a depressed mood. Towards the end of the second half, we became quite enthusiastic as the U.S. team scored two goals and took the lead. Just twenty three seconds before the finish, Portugal scored once more to tie the game and the heartbreak was felt among all of us. We felt frustrated as if the U.S. team had lost the game although it was a tie in reality.

If we did not watch the game closely, we would probably be quite satisfied with the end result. However, our mood shifted drastically due to the close attention we paid to the game. Similarly, it is natural to be affected by market swings. However, if our focus on the short-term leads us to act emotionally without proper examination of the long-term fundamental impact, it is better to ignore this market noise.

The Noesis Way

We see investment as a long-term process that requires patience and discipline. In good times, we know there will be plenty of “attractive” investment ideas that sound promising but command high valuations. Unless such an expensive valuation can be justified by sustainable fundamental metrics, we are not interested in chasing hypes and will wait to deploy your cash in better opportunities. We tend to be more careful when investors become “greedy” because we cannot predict when the sentiment will change. In bad times, we are more eager to search for gems that are oversold and could perform well when the cycle turns. If you have been with us through the Internet Bubble in 2000 and the Financial Crisis in 2008, you might remember that we advised you to stay invested.

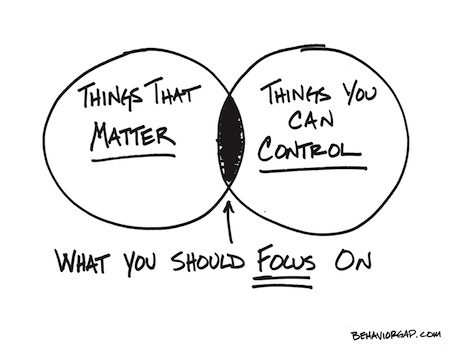

Our responsibility to you is to understand your financial goals and manage your portfolios accordingly to reach them. We advise to be disciplined and patient with your financial plans in order to avoid costly, self-destructive mistakes. We want to use a drawing by Carl Richard, the keynote speaker of this year’s CFA Institute conference, to visualize decision making in a simple but clear way.

In order to separate the market noise from the important data, we as investors should focus on long-term developments rather than temporary, short-term events. Additionally, we have more control in selecting individual companies than trading on macroeconomic trends or geopolitical events. For your financial plans it means focusing on your personal goals such as retirement and bequest to the next generation and control issues such as risk in the portfolios and taxation. Let’s focus on what we can control, what matters to us, and prevent our behaviors from getting in the way of reaching our goals.

Please contact us with any questions or comments you have.

Sincerely,

Noesis Research Team

Form ADV is available upon request