January 15, 2014

Dear Client:

2013 In Review

The final quarter of 2013 capped off the best year for U.S. stocks since 1995 with the S&P 500 Index rising an additional 10.5%. Industrial and technology stocks led the way during the fourth quarter as the U.S. economy rebounded surprisingly well during the second half of the year. As we entered 2013, the primary concern was of political discord regarding passage of a higher debt ceiling and a budget agreement. The Federal Reserve’s third program of quantitative easing, begun in 2012, trumped political turmoil and initially weak economic data to push U.S. stock indices to all-time highs, with returns surpassing other major markets around the world. Housing also continued its recovery as the median price for existing homes gained 15% over the course of the year. Meanwhile, the bond market suffered during 2013 as interest rates moved higher starting in May over concern that the Fed would begin reducing its active role of bond auction purchases. The 7-10 year US Treasury Index declined 5.8%, effectively losing two years of interest payments. Historically, 10 year U.S. Treasury bonds trade at an interest rate of 2-4 percentage points above the core rate of inflation. As of November, core inflation was up 1.7% annually. The 10 year treasury currently yields around 3.0% versus 4%+ if based on historical norms without Fed intervention to keep rates artificially low. As we expect interest rates to normalize and rise over the next 2-3 years, we remain underweighted in bonds.

Outside the U.S., emerging markets disappointed while developed markets showed improvements. China has reduced its GDP growth target to 7.5% for 2013 and potentially will reduce the target further for the coming years. The country can no longer rely on exports and infrastructure investments to boost its economy. In order to stimulate domestic consumption, China needs to solve its wealth inequality and environmental issues. The situation remains uncertain in the near-term, as China clamps down on its banking system to prevent excessive, speculative lending.

India and Brazil suffered from their unbalanced economy structure in 2013. In the case of India, the economy has a high current account deficit as a result of importing more than exporting. The fear of a less supporting U.S. Fed triggered an asset outflow of foreign investors and consequently led to a sharp decline of its currency. As a country with the second largest population and poor resources, India’s growth in the past decade relied heavily on its talent export in particular of IT engineers. With the U.S. tightening its immigration policy as well as Eastern European and Asian countries starting to participate in the talent pool, India has to pull other triggers to move its economy. Unfortunately, the Indian government has not performed to its potential and is slow to initiate meaningful reforms. In the case of Brazil, its economy is overly dependent on the export of its natural resources. With global demand for commodities abating, especially from China, its domestic consumption is not strong enough yet to offset the drag.

Similar to the U.S., the stock markets in Japan and Europe benefitted from aggressive monetary stimulus by their central banks. Japan is in a long decline for over two decades and has tried many different ways to turn it around. However, structural issues like its aging population and tight immigration policy cannot be corrected easily by monetary policy. Investors welcomed the action taken by the prime minister and the Bank of Japan but it is questionable if this will solve the long-term problems. Europe’s economic situation stabilized during 2013 due to the support from the European Central Bank and stronger union members as well as the slow implementation of reforms. Ireland was the first member to leave the bailout program and the rest of the “peripheral” economies showed a reversal of the negative trend.

The Year Ahead

There is a general consensus among economists and the investment community at-large that the Fed’s initial quantitative easing program (QE1) in 2008-2009 was instrumental in stabilizing the banking system and the economy during the financial crisis. The Fed felt the need to follow-up with QE2 as the global economy remained very weak, especially with our major trading partners in Europe.

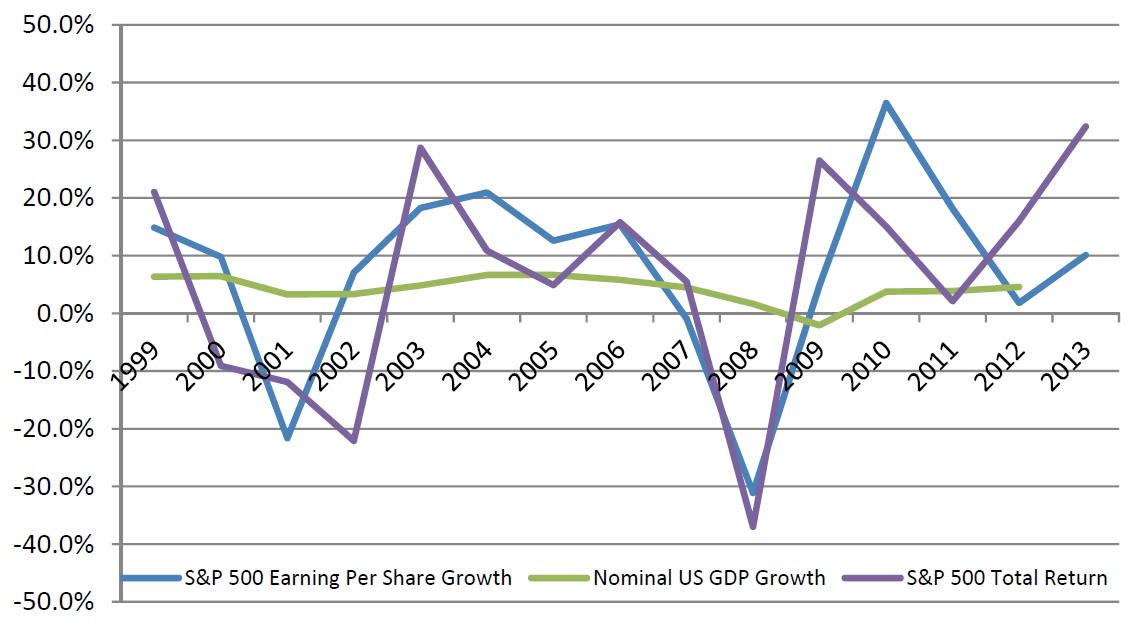

The effect of $85 billion per month of direct purchases of U.S. Treasury bonds and mortgages, known as QE3, has not had the desired effect of stimulating demand and reducing unemployment to the degree that the Fed had hoped. It has however provided additional liquidity to the financial markets and significantly impacted stock prices last year as evidenced through higher valuations (Price/Earing ratio – P/E). Over time, large corporations tend to grow their revenue in-line with GDP and grow earnings somewhat higher

through greater efficiency and productivity gains. As indicated in the chart, earnings have grown roughly 12% while the S&P 500 Index has risen over 53% over the past two years.

Source: Bloomberg, Bureau of Economic Analysis

Given the improvement in manufacturing data and a rising Index of Leading Economic Indicators, the Fed has announced it intends to reduce its bond purchases at a rate of $10 billion per month, potentially ending QE3 later in 2014. We recognize the tail-wind of excess liquidity finding its way into the stock market will abate, and we do not expect a repeat of greater-than-average annual returns experienced in 2012 and 2013 to continue. The P/E ratio for the S&P 500 is now close to 17 times versus a long-term average of 15 times. While this level is not immediately alarming, it likely presents a barrier to further upside in the near-term. Presently, we have a favorable environment where the Fed continues adding currency into circulation coupled with improving economic fundamentals. Economists estimate that U.S. GDP will grow close to 3% in 2014 versus just under 2% in 2013. As 2014 unfolds and the effect of the Fed diminishes, we recognize that many stocks could be left in a vulnerable position in spite of continued earnings growth, and we will exercise prudence in order to manage the volatility in the event of a correction.

The estimates for global GDP growth in 2013 are 2.3% and rising to 3% in 2014 with the bulk of improvement coming from developed markets. Given the excess global supply of both labor and manufacturing capacity relative to demand, we anticipate inflation will remain subdued for the foreseeable future.

Conclusion

2013 benefitted handsomely from accommodative central banks in developed markets and marginal economic improvement. The headlines on the evening news of political shambles, government shutdown and multiple military conflicts overseas were simply not a factor. As we begin 2014, we remain aware of the potential risks and seek opportunities in accordance with our process of seeking strong competitive companies trading at reasonable valuations. We welcome your questions or comments, and we are honored to serve you each day.

Sincerely,

Steve Smith, CFA Shihfang Chuang Christian Paterok

Research Team