Dear Client:

2015 Review

2015 proved to be a challenging year as most major global equity markets posted negative returns. After rising almost 3.5% through mid-May, the S&P 500 fell over 12% by late August, before ending the year at -0.7% on a price basis. The Dow Jones posted its first decline since 2008, even after including dividends. Likewise many of the international indices were also down in 2015.

Equity Markets’ Returns in U.S. Dollar Term

| Index |

USD Return |

| S&P 500 Large Cap |

-0.7% |

| Dow Jones Industrial Average |

-2.2% |

| S&P 600 Small Cap |

-3.4% |

| MSCI EAFE (Europe, Australasia, Far East) |

-3.3% |

| MSCI Europe ex-U.K. |

-2.6% |

| MSCI Emerging Markets |

-17.0% |

| Nikkei 225 |

8.0% |

| Hong Kong Hang Seng |

-7.1% |

| Shanghai Shenzhen CSI 300 |

1.0% |

Our outlook for 2015, one year ago, included the continued trend of a strong dollar, low inflation, growth in earnings, and elevated market volatility. Stocks were indeed more volatile as evidenced by 71 days of daily moves greater than 1%, versus only 38 days in 2014 in the S&P 500 holdings. The price volatility was primarily centered on uncertainty in the timing of the Fed interest rate hike, and concerns of a global recession brought on by a slowing Chinese economy. Furthermore the strong performance of a few mega-cap stocks masked the weakness of the broader market, indicated by the -4.11% price return of the S&P Equal-Weighted Index. 301 S&P stocks ended the year in negative territory, with 14 losing more than 50% of their value. Of the 6,767 U.S. listed stocks 4,416, or 65%, finished lower on the year.

Earnings growth was deeply impacted by the collapse in the oil companies and the strength of the dollar which reduced revenue for virtually all multi-national corporations. We note that most of the segments of the fixed income market posted calendar losses. With the negative returns from bonds and most stocks, 2015 was an especially difficult year for balanced accounts, such as public and private pension plans, given a typical 60% equity and 40% bond allocation.

2016 Outlook

For the first time in 10 years, the Federal Reserve Bank increased the Fed Funds target rate in December, backing away from its “zero interest rate policy.” In early 2015, the Fed indicated its expectation of four rate hikes by year end, creating price swings prior to each Fed meeting. Likewise, the Fed indicates four rate hikes over the next 12 months. While we do not believe the domestic economy is growing strong enough to warrant more than one increase in 2016, we do recognize that P/E multiples, which have been rising since 2009, are not likely to expand much further in an environment of slowly rising rates. Conversely, we believe earnings growth will rebound in 2016. For 2015, the Energy sector alone is expected to reduce S&P earnings by as much as $15 following the decline in oil prices. S&P earnings for calendar 2015 are forecasted to be in a range of $117.60- $118.70 per share, posting 4- 5% growth over 2014. One year ago, the consensus forecast for 2015 was for earnings to grow 9.4%. The Energy and Mining sectors were significant drags on earnings results in 2015 as commodity prices across-the-board were weak. Even after significant reductions in earnings estimates, Wall Street analysts conservatively forecast a range of $127.20- $127.60 in 2016, portending growth of about 7%.

The first full week of trading in 2016 saw the S&P index drop 6% while the NASDAQ fell by 7.3%. Although corrections are common (we pointed out in a previous letter that the S&P had been negative at some point in every calendar year since 1979), the media has made much of the fact that this is the worst first week in history. We saw profit-taking in last year’s leaders once the New Year arrived, and those names have been among the biggest decliners. We are now within 3% of the intra-day lows seen last summer, and feel as we wrote then that much of the selling has already passed. As we move through earnings season and investors begin to focus on future corporate results, we anticipate crude oil will find a bottom and look for the equity market to stabilize with new leaders emerging in the coming year.

As indicated above, we experienced a volatile market in the summer mostly due to the Chinese stock markets’ turmoil, and the sudden devaluation of the Chinese Yuan. One of our analysts, Shihfang, had a chance to experience firsthand the slowdown of China’s growth. She made her third visit to China in November to attend an investment conference in Shanghai and visit with clients. Below is her takeaway from the trip:

China Trip Takeaway

I landed at the Shanghai Pudong International Airport on a Monday night. It is one of the international hubs for China and the world’s third largest airport by cargo traffic. The structure of the airport is impressive and appears well maintained. Along part of the highway leading to the city center, I saw the Shanghai Maglev Train which is the first commercially operated magnetic train in the world. The Chinese built the track themselves while the train was built by two German companies. The train has an impressive maximum speed of 268 miles per hour. Just like the other Chinese cities I have visited before, it appeared to me that they are trying to give the best impression to guests upon their arrival.

The conference was held in one of the hotels in Shanghai’s financial district. As with many other financial centers around the world, I saw skyscrapers, up-scale shopping malls and fancy restaurants in the vicinity. However, due to poor air quality, I couldn’t clearly see one of the landmarks in Shanghai – the Oriental Pearl Tower – even though it is located just a few blocks away from my hotel window. The winter winds from Northern China carry part of the smog to the south as far as Taiwan, which amazed me because it is more than a thousand miles away. For a lot of Taiwanese and Chinese, a daily routine before going to work is checking the air quality indicators. While I was working on this summary, Beijing announced the very first red alert ever on air quality and put most of the capital’s activities on pause. In China’s big cities, air pollution is the biggest threat to its residents.

Air pollution is a result of the “Old China,” which was heavily reliant on investment in infrastructure to grow their economy. The industries resulting from this investment are responsible for most of the pollution. They are mostly owned by the state and local governments (aka SOEs – State Owned Enterprises), which have been the key executers of China’s closely followed growth recipe. This rapid growth has left the country with overcapacity problems in industrial sectors, social issues in the large cities, and environmental damages. Growth dislocation due to rapid urbanization and an out-of-date Hukou (household registration) system have created social inequalities in top tier cities and have left most of the inland regions underdeveloped. (On 12/10/2015, Beijing announced it will start to grant household registrations to those people who have migrated to the city.)

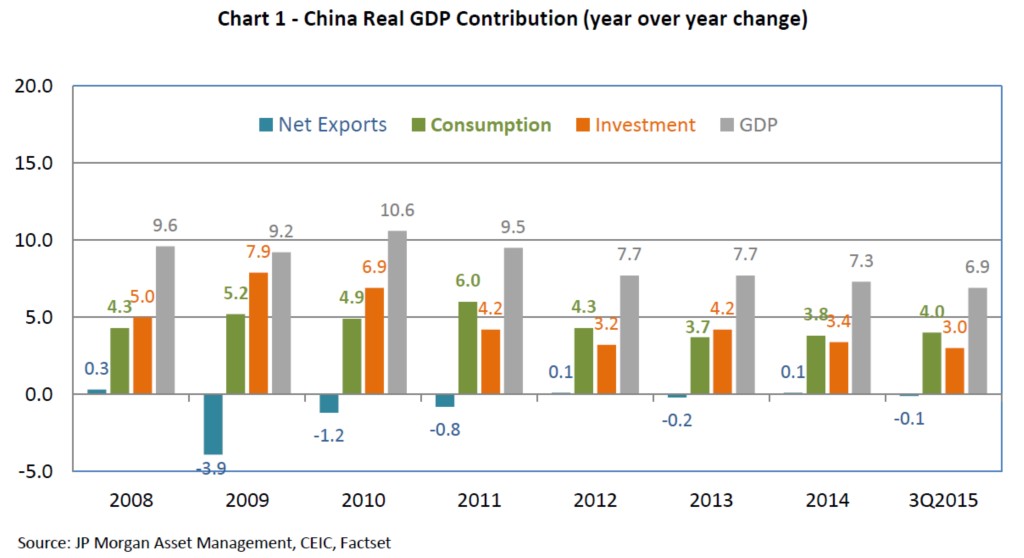

The evidence of China’s awakening from this unbalanced growth is obvious. The service sector has been expanding rapidly, fueling wage growth and supporting consumption. Consumption has become a stronger factor for GDP growth in recent time and we believe this trend will continue (See Chart 1). It was no coincidence that the theme of the conference was “Young China.” I was fortunate enough to be in China to learn what this “New” and “Young” China means for the world.

China is an immensely populated country of more than 200 large cities, each with more than one million inhabitants. Shanghai alone has 31 million people living in the city, compared to New York City in the U.S. which has 8.5 million residents. The need for infrastructure, transportation, housing, and food propelled the “Old China’ for three decades and lifted millions of people out of poverty. However, the “Old China” is running out of steam. The residential square footage per capita is higher than many developed countries, there are multi-lane highways leading to empty cities, and commodities pile up at the sea ports. The need for China to transform from an economy that mainly takes care of the basic needs of its 1.3 billion citizens to one that fulfills people’s demand for health care, education, entertainment, and a sustainable environment is pressing. Luckily, this has already started as indicated in Chart 1.

By 2050, one-third of China’s population will be 65 or older. This aging population already makes China one of the largest markets for orthopedic and cardiovascular medical equipment. In 2013, China’s health care spending per capita was US$367, which was lower than Cuba, Colombia, Venezuela and most Eastern European countries. Because the government owns a large part of the healthcare service industry and public facilities serve the majority of the patients, there is significant demand for investment in private clinics and hospitals with higher quality. Many Chinese, who can afford to do so, have chosen to go abroad to have their medical procedures done.

In an effort to counter the trend of aging and labor shortage, the government formally announced the abandonment of its one-child policy in October 2015. Generations born during the enforcement of the policy have received higher education and enjoyed better products and services and hence, become more affluent consumers than their parents. As in many Asia regions, women in China are empowered due to their improved financial independence. They contribute more than half of the household income in urban areas and gain more control on purse string. They are the key decision makers on categories such as home products and furnishings, maternity and children’s, and personal care. They are the top tier online shoppers and amazingly, more than 64% of them browse for products and services at least once per day according to Economist’s research in 2014.

While at the conference, I also learned that China is going to generate the world’s biggest box-office sales by 2020. China’s role in the movie industry is far beyond just a huge movie goers market; it also serves as the place to find investors for productions and ideas for Pan-Asia themed stories and materials. China’s underdeveloped sports market is also expected to increase six-fold from 2014 to 2017, which translates to an annual compounded growth rate of 20%. The sports market expands from the consumer goods to sports events, broadcasting rights, and ownership of clubs, teams, and arenas.

The “New China” also includes a big leap into e-commerce and m-commerce (purchases done on mobile devices). China’s e-commerce sales grew over 50% in 2014; reaching 10.7% penetration vs. 7.6% in the U.S. In 2014, the mobile platform accounted for 41% of online purchases made by Millennials. China’s 415 million Millennials, born in the 1980’s and 1990’s, are rapidly becoming the prime consumers in China. Raised in single-child families, shaped by China’s rapid economic growth, and powered by internet and technology, Chinese Millennials spending habits are considerably different from their parents. They prefer individualized products and services over the mass produced ones and are eager to consult and contribute to peer reviews before and after purchases.

O2O (online-to-offline) business has been one of the hottest areas for innovation. O2O is booming for food delivery, transportation, and personal care categories. It was estimated that the food delivery business through the O2O platform in China will reach US$6.5 billion in 2017. Uber-like transportation services (shared car-ride) in China might change the auto industry in a big way. Cars, used to be regarded as a big-ticket consumption item, might soon be considered as an asset class. With the air pollution problem looming over government officials’ heads, China might be the birth place for greener vehicles designed specifically for shared car-rides.

On the ePayment front, China has run ahead of other countries in my opinion. Over 400 million Chinese have an online-payment account which is used to pay for both online and offline purchases. Chinese mobile phone users now can integrate messaging, shopping, payment, gaming, and other services through a single app on their phones. In 2013, the number of transactions processed by Alipay (the most popular ePayment in China, independent of Alibaba Group) almost equated to those made by bank cards.

Other than sensitive political topics, the Chinese government has minimal restrictions on how the internet/mobile industry should evolve in the future. If the government continues to allow the maximum freedom enjoyed by the internet companies, Chinese companies, once famous for their copycat business models, will soon be recognized as the world’s leading innovator in m-commerce.

No doubt, the next leg of growth has to come from the consumption of personal goods and services by the massive population of Chinese citizens. Whether the spending is on health care, entertainment, financial services, higher quality foods, tailored products or technology, the “New China” has to be more sustainable and balanced in many aspects. It is no surprise that the outlines of China’s 13th 5-year plan happen to be “Innovation, Coordination, Green, Open and Share.”

The future of China depends largely on a timely and successful transition from the “Old China” to the “New China.” During this process, many failing SOEs will face the biggest consolidations and eliminations in the history of China. Millions of people employed by these SOEs will have to find jobs somewhere else, and their local governments have to fund their welfare and feed their citizens from brand new sources. While China gradually opens its financial markets, most state-run financial institutions will be forced to adopt a leaner business model while avoiding losing customers and important human capital. The “New China” endeavor is full of uncertainty and may not fully offset the deterioration of the “Old China.” Nevertheless, Chinese people seem to have a lot of confidence in their government even after experiencing the stock markets and currency turmoil during last summer. Several presenters at the conference suggested that the populous still looks up to the government to provide the ultimate solutions for their problems.

While waiting in the airport for the return flight to the States, I met a young lady and had a long conversation with her. She traveled the world in her college years, worked in Guam and Japan for a few years, and returned to China to open her own business. She was about to finish a business trip that took her to Beijing, Wuhan, Shanghai, and Kunming (which means she covered about half of China) in five days. She was energetic, optimistic, and competitive which reminded me of the impressions of the “New China” I got during my trip. There remains a big gap for China to catch up with the developed world, but the hundreds of millions of young Chinese like her might be able to close that gap sooner than most people believe. After seeing the “New China,” it would be difficult for me not to be confident about the future of China.

During the summer turmoil, our research team recommended HengAn International as a way to participate in the China consumer theme. HengAn is the largest domestic producer for adult and baby diapers, sanitary napkins, and paper tissues and is well-positioned to benefit from these demographic changes: Aging population, more babies, and empowered woman consumers. There remain many opportunities for us to explore and our research team will bring you more insights as we continue our efforts in understanding the “New China.”

Thank you for the opportunity to serve you and for the referrals you gave us in 2015. We look forward to hearing your views and addressing any questions that you may have.

Sincerely,

Noesis Research Team

Form ADV is available upon request