Dear Friend:

Global equity markets have been resilient during the past three months in spite of hurricanes, cyber hacks, and North Korean missile tests, with most major market indices adding to their 2017 gains. U.S. stock indexes posted their first positive return during the month of September since 2013, and this year was the least volatile September on record. Strength in equity markets remains supported by excess global liquidity supplied by major central banks, earnings growth from slowly improving global economies, and tepid inflation. The Institute of Supply Manager’s Manufacturing Index released for September rose to its highest level in 13 years, while the core Personal Consumption Expenditures Index rose only 1.4% on a year-over-year basis through July. As earnings season approaches, we expect a continuation of solid performance across most industries, in spite of the negative impact on GDP growth by the hurricanes during this reporting period.

We try to shift the focus away from the daily market noise and headlines towards the fundamentals of companies, industries, and economies. For example, in today’s letter we examine the retail industry and highlight certain players. We believe that forecasting the market on a consistent basis is NOT possible. Identifying individual sustainable businesses with strong fundamentals that offer the potential to prosper in the long-run across economic cycles IS possible.

Disruption in the consumer world

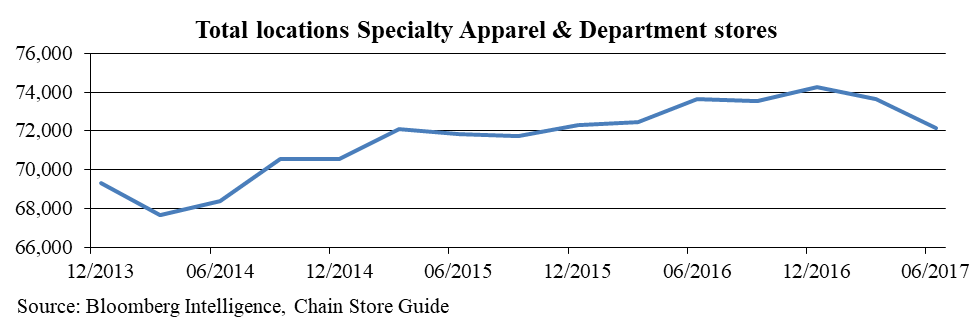

While stock markets stayed quite calm in recent months, one area, the retail industry, is delivering one headline after the next of bad news. The department store Macy’s announced 100 store closings over the next few years, J.C. Penney shuts down 138 stores in 2017 alone, and Kohl’s plans to downsize 500 stores by year-end. On an aggregate level, you can see a drop in store locations since the beginning of this year, and judging by the various company announcements, that downward trend might accelerate (see chart below).

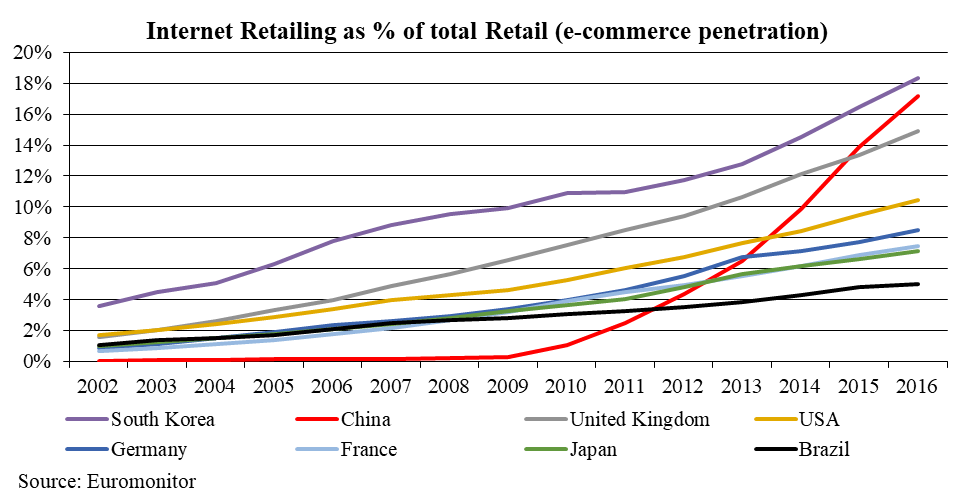

The culprit for this development is easily identified: Online shopping led by e-commerce heavyweight Amazon. Retail traffic to stores in the U.S. has been declining for years as consumers prefer the convenience and often better value of internet retailing via websites and mobile apps. The shift towards e-commerce is global and in some countries accelerating as the chart below indicates. In South Korea, China, and the UK more than 15% of retail sales is online and in the U.S. the penetration is around 10%.

While overall more goods and services are sold online, the degree varies by product category. For instance, in the U.S. around 45% of travel sales are digital, 32% of consumer electronics, 15% of apparel and footwear, and only 3% of groceries. The low e-commerce penetration and the fact that it is the largest retail category probably explain why Amazon decided to enter the grocery industry through the acquisition of Whole Foods Markets in June this year.

Following the business news in the past months, it feels that Amazon will take over the world. Speculation that the company might enter another retail segment is often enough for price drops of the companies participating in that particular segment. The threat of changing shopping behavior in general and of Amazon in particular is in many cases justified.

We want to show in a few examples how the consumer companies that we own are adapting to this environment. In general, we prefer to invest in the brand rather than in the distribution channel as with growing online penetration the middleman is often skipped and the brand sells directly to the consumer. Our preference is for large, dominant brands that control the vast majority of their own distribution as well as retailers that are relatively immune to the threat of e-commerce.

Nike

The worldwide largest athletic footwear and apparel maker is confronted by a bifurcation in sales channels, in particular in its North American market. Nike’s direct-to-consumer (DTC) sales through company stores, website, and apps represents 28% of total sales and is growing at a healthy, double-digit rate. On the other hand, sales through its wholesale channel – around 35% of total sales – are declining. Large sports retailers such as Foot Locker and Dick’s Sporting Goods suffer from declining sales or in the case of Sports Authority, it went out of business. Nike’s response is to focus on differentiated wholesale formats like House of Hoops (by Foot Locker), while deemphasizing generic, undifferentiated wholesale distribution and to expand its DTC channel. Management recently announced a sales pilot with Amazon in the U.S. and while it is too early for results, experience with T-Mall in China and Zalando in Europe are good. Interestingly, in its high-growth, high-margin market of China, 90% of sales comes through the DTC channel indicating that if Nike has full control of its distribution and brand narrative, results are positive.

Disney

Changes in consumer’s viewing behavior, enabled by widely available high-speed internet and smart phones, is impacting the cable network industry including Disney’s sports network ESPN. Viewers increasingly shift to online streaming services and cancel or reduce their cable subscriptions, so called cord-cutters, leading to a subscription decline of 2-3% at ESPN in the past quarters. Disney owns a portfolio of strong brands and content but is currently challenged by the changing way of distributing it. Last quarter, management announced the overdue step of starting their own DTC streaming services: An ESPN branded service is expected to launch in spring 2018 and a Disney branded service, including Disney, Pixar, Marvel, and Lucasfilm movies and television shows, to launch in late 2019. At the same time, the company is discontinuing its licensing agreement with Netflix which streamed Disney and Pixar movies on its platform. With this strategic move, Disney takes greater control of its online distribution and will have direct access to the viewers and their data.

Home Improvement Retailers

Lowe’s, together with Home Depot, are the leaders of the U.S. home improvement retail industry, a duopoly with only smaller competitors. Due to the nature of its assortment (from bulky items to a single nut and bolt), set-up of their customer base (professional customers represent around 30% of Lowe’s sales and 40% of Home Depot’s sales), and the additional services they offer (home improvement project solutions, product advice, financing), both are relative immune to the threat of e-commerce. The online sales penetration for the overall product category is low at around 5%. Lowe’s various online selling channels contribute only around 4% to its total sales and 6% in the case of Home Depot. Their online presence spans beyond simple product search to idea generation, project planning, and product guidance.

Why not Amazon?

The brick and mortar retailers experienced a high magnitude earthquake when Amazon announced the acquisition of Whole Foods Market in June. The company’s bold action to penetrate grocery items was not expected since its prior actions on fresh delivery and Amazon Go stores did not pick up steam. Amazon’s ambition is for its customers to shop everything in the most convenient way on its platform. Its business model certainly benefits a lot of consumers; however, we question whether its operating performance really lives up to the enthusiasm of its stock. Amazon operates in two business lines: retailing and cloud services. The trajectories for margin improvement in these businesses are not encouraging due to intense competition. AWS, Amazon’s cloud services, is generating all the profit for Amazon but encounters severe challenge from Google and Microsoft, which both have stronger financial capabilities than Amazon. Furthermore, the cloud business requires constant investment to stay relevant in the competition. Unlike the other names in the FAANG basket (Facebook, Apple, Amazon, Netflix, Google), Amazon has not proven it can generate a sustainable profit. For example, in the recent quarter it generated 50% less operating income than last year and this is the 23rd year in business. The below table shows that Amazon’s operating margin is only comparable to traditional retailers; however, its stock is more expensive than most retailers and even higher than very profitable IT companies like Microsoft and Google. With tight margins and the requirement for continuous capital expenditure, the possibility of a capital return to the shareholders in the near-to-medium term is low. Therefore, Amazon investors’ returns heavily rely on other investors’ enthusiasm about the stock instead of on the financial performance of the business model.

Company | Operating Margin | EV/EBITDA* Trailing 12 months | Price/Free Cash Flow per share |

| Amazon | 8.6% | 35.2 | 27.4 |

| Walmart | 6.7% | 8.6 | 8.6 |

| Lowe’s | 11.2% | 10.2 | 10.7 |

| Microsoft | 24.8% | 17.0 | 14.7 |

| 32.5% | 17.0 | 17.8 |

*Enterprise value / Earnings before interest, tax, depreciation and amortization.

Amazon challenges and disrupts the traditional distribution channels of goods. More than pricing, the convenience of comparison, availability of user reviews and the low cost of delivery all increase the stickiness of their client base. However, online shopping still has its limitations and the barrier to entry is not high enough to fend off new and existing competitors. For example, brand name companies such as Nike might want to bypass these middlemen all together and run a DTC online interface. The existing retailers could also add and improve their online exposure as in the case of the home improvement retailers. We are less interested in picking a winner among the distributors but more interested in knowing who will be obsolete and which brands and products will benefit from the leveling of the distribution channels. Because in the end, prices and quality of the products still dominate the consumers’ decisions.

As we approach the end of the year, please remember if you wish to make gifts to charities or individuals to contact us before December.

Sincerely,

Research Team

Form ADV is available upon request